|

| Indian gold jewelry demand is making a comeback |

Growth in U.S. gold jewelry demand resumed, leading to the strongest first quarter since 2010, the World Gold reported Thursday, as demand rose 3% year-over-year to 22.9 tons. The U.S. is firmly the world’s third largest market for gold jewelry.

The WGC Gold Demand Trends report for the first quarter of 2017 credited this growth to a post election lift in U.S. consumer sentiment. "Plain yellow gold was more popular in the U.S. than in European markets," WGC said in the report. "High end and online retailers performed strongly. The online segment is also gaining strength, particularly with continued growth in ‘clicks and mortar’ retailing—the overlap between the virtual and physical retail environments."

The U.S. was one of the few bright spots in a world still challenged by regional geopolitical and economic issues causing uncertainty throughout the world. More importantly, demand was curtailed by a 9% rise in gold prices from the end of December till the end of March.

A first-quarter surge in gold jewelry demand in Indian was enough to fuel a year-over-year 1% increase in global gold jewelry demand in the first quarter to 480.9 tons, according to the WGC. However, it is compared against an extremely poor first quarter of 2016.

“Gold jewelry demand was broadly steady, but remains weak in the longer term context,” the WGC said in its report. “Demand was 18% below the 587.7-ton five-year quarterly average.”

India

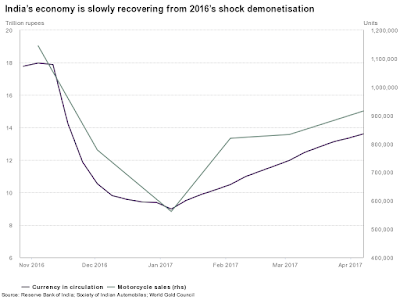

In November 2016, the Indian government implemented a surprise demonetization policy that removed Rs15.44 trillion, or 86 percent, of the currency in circulation from India’s economy. This had an immediate devastating impact on the whole Indian economy, including the gold jewelry sector. It was the culmination of an extremely challenging year for India’s gold jewelry industry that included strikes, even more government regulations and high gold prices. All of this led to a seven-year low in gold jewelry demand in India in 2016.

Against this backdrop a 16% year-over-year increase in gold jewelry demand to 92.3 tons in India in the first quarter of 2017, as reported by the WGC, isn’t as strong as it first appears. India’s importance in the gold jewelry marketplace can’t be underestimated. China and India accounted for nearly 56% of global gold jewelry demand in the first quarter.

The WGC emphasized that despite the high quarterly gain gold jewelry demand remains weak, primarily due to the high cost of the precious metal. The good news is that “by the end of March, 85% of the value of currency removed from circulation under demonetization had been returned,” the WGC said in its report.

The WGC said the outlook in gold jewelry demand in India is “robust” with one caveat. “The market is wary of the forthcoming decision on GST (Goods and Services Tax— a comprehensive indirect tax on manufacture, sale and consumption of goods and services throughout India, with the exception of Jammu and Kashmir) and this will likely weigh on demand until the government’s final decision, due for implementation in early July.”

China

The massive, populous and increasingly upwardly mobile country is now easily the world’s largest market for gold jewelry. Demand for gold jewelry was down 2% year-over-year to 176.5 tons.

An early Lunar New Year pushed gold jewelry demand in January, the WGC said. This was followed by a strong wedding season. However, “once the festivities were over, demand dropped off as usual—an effect that was more pronounced due to the backdrop of rising gold prices.”

The WGC described the gold jewelry industry as resourceful, but a slowing economic environment and changing consumer tastes are having a negative effect on gold jewelry demand.

China, known for 24k gold jewelry, has experienced an increase in 18k products. Manufacturers responded by offering more intricate and contemporary designs. A new 22k segment was introduced to cater demand for new, innovative and trendsetting pieces. In addition, some retailers are increasingly becoming specialized in bridal jewelry.

“So, although demand in China faces headwinds from the economy and the changing tastes of its consumers, the industry is keen and determined to adapt—an attitude that should help stem any weakness,” the WGC said.

Other Asian Markets

Jewelry demand within the smaller Asian markets was hit by a combination of rising gold price and rising political tensions in the region. In the face of rising gold prices, Japanese jewelry demand fell 9% year-over-year to 3.2 tons. A drop in Chinese tourists also was cited as a reason.

In Thailand, sluggish economic growth contributed to a 5% decline in first quarter jewelry demand to 3.1 tons. “The government responded with several measures designed to boost the domestic industry,” WGC said. “These included waiving tariffs on raw material imports used in jewelry production , and making low interest loans available for small and medium sized businesses to upgrade machinery.”

Europe

Jewelry demand was again dragged down by weakness in France and the U.K., the WGC said. The rest of the region was stable. Demand fell 6% in France due to pre-election uncertainty and the rise in terrorist activity which has impacted tourism, the WGC said. In addition, branded silver is making continued inroads into market share.

The U.K. saw a 7% year-over-year first quarter decline to 3.7 tons.

Middle East and Turkey

Demand in Turkey sank to a four-year low of 7.7 tons, the WGC said. Continued currency weakness in Turkey meant that the price of gold in lira rose more than in any other currency during the first quarter (+12%), undermining jewelry demand, which fell by 11% to 7.7 tons.

“The fragile economic and political conditions that have beset Turkey over recent years were again a key factor behind the weak Q1 number,” the WGC said. “The mid-April referendum on changing Turkey’s constitution from a parliamentary to a presidential republic weighed on demand for the sector. And the outlook for the market is weak as the local price remains prohibitively high for many at a time of deteriorating economic indicators.”

Demand in the Middle East was unchanged at 54.6 tons and it followed a familiar pattern, the WGC said. Jewelry demand in Iran jumped 27% in the first quarter year-over-year to a four-year high of 12.9 tons, helped by an improving economy and investment-driven purchases.

“Demand across the rest of the region remained weak in the face of low oil prices and subdued tourist numbers, the impact of which was exaggerated by rising gold prices,” the WGC said. “Although the UAE has imposed a 5% import duty, demand in that market was relatively robust as consumers rushed to buy before the full effect of the tax fed through to end user prices.”

Overall Gold Demand

The WGC Gold Demand Trends report—which tracks demand in gold for investments, jewelry and technology; and tracks gold supply as well—reported that overall global gold demand in the first quarter declined 18% to 1,034.5 tons. However, it is in comparison with the first quarter of 2016, which was the highest first quarter ever.

There was slower demand in Exchange Traded Funds and in central banks. Bar and coin investment, however, was described as “healthy” while demand “firmed slightly” in both the jewelry and technology sectors, the WGC said.

Please join me on the Jewelry News Network Facebook Page, on Twitter @JewelryNewsNet, the Forbes website and on Instagram @JewelryNewsNetwork